ASSESSOR'S OFFICE

The Assessors’ Office is responsible for discovering, describing and determining property value of all Real and Personal Property subject to property taxation, and must comply with Maine State Statutes, primarily Title 36 of the Maine Revised Statutes (MRS).

The Assessors’ Office prepares a list of these properties annually and commits the assessments to the Tax Collector for collection. The Maine State Department of Revenue Services audits the Assessing Office annually.

April 1st is the status and situs date for all taxable property in the state of Maine (36 MRS § 502).

Please take full advantage of the various programs available to ease the impact of property taxes.

- Access Tax Records Online

- Blindness Exemption Application

- BETE Application

- Homestead Exemption Application

- Tree Growth Application Schedule

- Veteran Exemption Application

- Widow’s Veteran Exemption Application

- Q&A Tax Relief Programs

Applications for all of the above listed exemptions must be made on or before April 1st of the year in which they are sought. The Business Equipment Tax Refund (BETR) and Business Equipment Tax Exemption (BETE) programs are available to those commercial and industrial properties that meet certain established criteria.

Assessors’ Agent – Linnell M. Geronda, CMA

Assessors’ Assistant – Kristin Haase, CMA

Board of Assessors

Richard Lovejoy-Chairperson

James Rinaldo – Member

Craig Chamberlain – Member

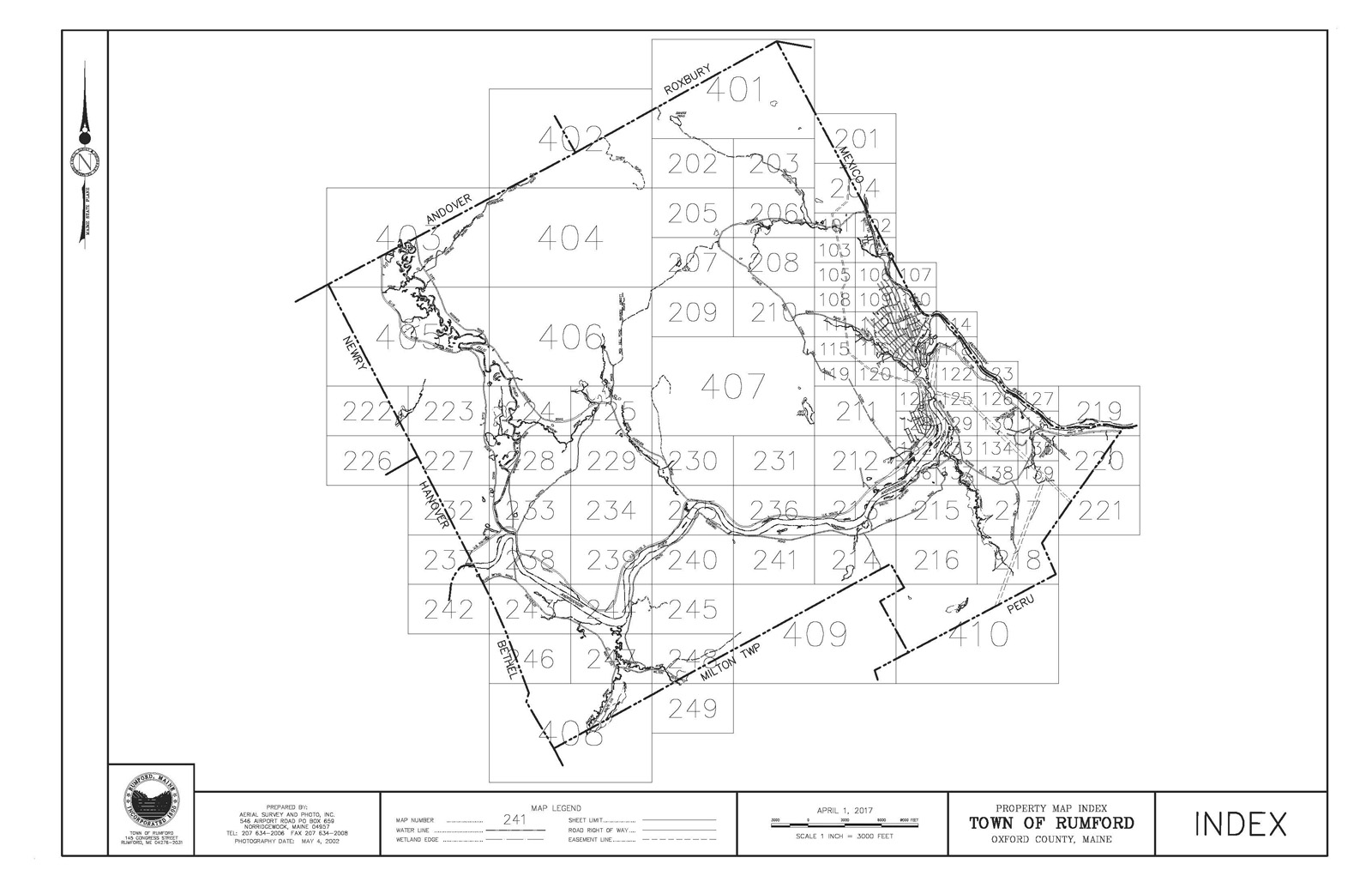

2023 Interactive Tax Map