TAX and SEWER OFFICE

TAX AND SEWER OFFICE

The Tax Office is responsible for collecting monies received for various taxes, sewer fees and charges. These include Real Estate and Personal Property taxes, motor vehicle taxes and fees, registration fees, and other taxes related to Inland Fisheries & Wildlife, and various other charges. The Tax Collectors Office strives to provide the highest possible level of customer service to the Town’s residents and taxpayers while maintaining strict control to ensure the proper posting and accounting of the funds received.

Property taxes are due in two installments and are set each year by the Select Board. Normally the first installment is due during the month of October and the second installment is due on April 1st.

Property taxes are due in two installments. The mil rate for the current year is $18.73.

1st Installment Due: Friday, November 21, 2025

2nd Installment Due: Wednesday, April 1, 2026

Can I use a credit and/or a debit card to pay my taxes?”

The Tax Collector’s Office currently accepts Visa, MasterCard, American Express and Discover for all transactions EXCEPT property tax payments that are in lien status. However, debit card transactions are not accepted.

Credit cards are accepted with online transactions through PayPort Online Payment Portal. Third party fees apply to all credit card transactions.

Rumford Property Tax Payments Rumford Sewer Payments

I sold my property, why did I get a tax bill?

Although the Town’s tax year runs from July 1st to June 30th the taxes are assessed against the owner of record on April 1st. The April 1st date is set by State Law and is used by all communities. If you disposed of or sold your property after April 1st you are still responsible to pay the assessed taxes, even if they have not been committed yet. A purchase / sale agreement is a private agreement between you and the buyer of the property and does not automatically terminate your tax obligation. If the Town is required to file a tax lien for unpaid taxes, the lien will be filed in the name of the assessed owner as of April 1st. The Rumford Tax Collector highly recommends that all taxes, not just the current installment, be paid in full at your closing.

What if I lost my tax bill?

The Town mails one tax bill a year, normally in early September. If you have lost or misplaced your bill you can contact the Tax Office at (207) 364-4576 ext 215 to obtain the balance due and your account number or may access tax records online to check account balances and print a tax bill. Referencing the account number on your payment will ensure proper posting and reduce processing delays.

Online Services

Documents

- Access Tax Records Online

- Sewer Abatement or Correction Application

- Motor Vehicle Registration

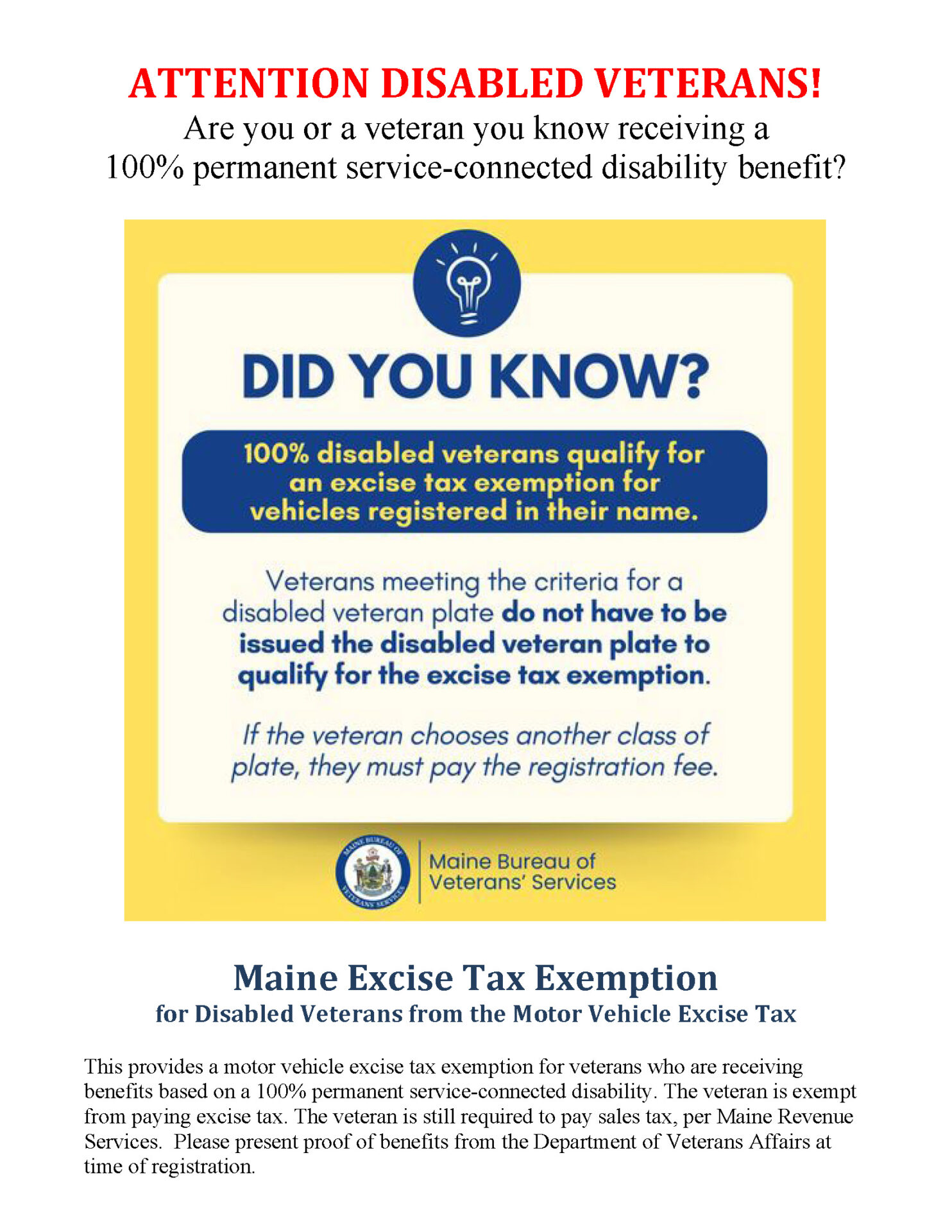

- Disabled Veteran Excise Tax Exemption Information

- ATV, Snowmobile, & Boat

- Tax Club Agreement

- Tax Club Program

- 2026 Real Estate Tax Bills

- 2026 Personal Property Tax Bills

- 2026 Commitment Book Personal Property

- 2026 Commitment Book… Real Estate

- 2026 Commitment Book… Real Estate Map & Lot

Inland Fisheries & Wildlife

NOTICE of Residency and Registration compliance (new and renewal)

Residents and non-residents may obtain hunting and fishing licenses from the Town Office or any Agent for the State of Maine Inland Fisheries & Wildlife Department. For more information and pricing visit the IF&W website http://www.maine.gov/ifw/.

Please be prepared to show photo ID and proof of residency.

NOTICE of Residency and Registration (new and renewal) compliance – effective October 1, 2018

NOTICE FOR ALL IF&W/MOSES TRANSACTIONS

Proof of residency is currently, and will continue to be, required for ALL transactions (licensing, registration, AND renewals). There are the 4 approved “Proofs of Residency” for IF&W licenses/registrations. You must produce ONE of the following documents and meet ALL 4 criteria:

- Valid Maine Driver’s License or Maine State ID

- Active Maine voter registration.

- Valid State Maine BMV vehicle registration.

- Current and compliant Maine Income tax payment.

Non-resident licenses/registrations are available for non-residents.

NEW/USED BILL OF SALE for any recreational vehicle (ATV, snowmobile, boat, jet ski, etc.) must include the following information:

- Vehicle Serial Number / VIN (year, make and model must be known, but not necessarily on the bill of sale).

- Seller name and address.

- Buyer name and address.

PLEASE BE AWARE: Bills of sale lacking any of the above information will not be accepted and therefore those vehicles cannot be registered.

RE-REGISTRATIONS

It is required that you either bring in the expired registration, OR have a written note with serial &/or registration number, OR that you can verbally recite the registration number &/or serial number associated with the vehicle you wish to make current. We are no longer to search for vehicles to re-register using owner name or MOSES ID.

We understand that there may be some confusion and/or inconvenience involved with this process. We appreciate your understanding and your support of compliance with these laws, which are in place to protect the rights of all sports people in the State of Maine.